Building a globalist-free society

What would that world look like? What financial system do WE want?

Our collective awareness that this Agenda 2030 the globalists have planned for us useless eaters does not end well for the useless eaters is rapidly approaching the tipping point.

So the UN is starting to spit like a cornered bully and scream for “emergency platforms that swing into action automatically.” When UN Secretary-General António Guterres calls for a sweeping overhaul of the United Nations Security Council and the global financial system, you can bet that we regular humans are the ones to be hauled over the side and swept out to sea at their “Summit of the Future” starting Sunday. Related “Action Days” are happening now.

“The proposed “Emergency Platform”… if enacted would give the UN secretary-general the authority to declare and manage global emergencies, effectively granting one individual sweeping powers over the international community during any future crisis – real or perceived.”

Declaring a fake “emergency” is the theatrical hand-wave gesture globalists have contrived to put believers into a fear state while conjuring a quasi-legal liability cover for their antihuman policies. Flashback to Jan. 31, 2020: one individual, U.S. HHS Sec’y Alex M. Azar II, “declared” an “emergency” that would authorize (among other abuses) the manufacture and distribution of DOD-made untested prototype EUA countermeasures they pretended were “vaccines.” The earliest suspected “covid”-related fatality was not until Feb. 6, 2020, per the NYTimes. What “emergency”?

So the globalists are trying to upsize that trick: give one individual in the whole world the power to declare fake real or perceived emergencies that trigger “platforms that swing into action automatically.”

Looks like the cabal is fed up with pretend play toy democracies and think it’s time to reload the emperors and gods game.

In a classic case of doublespeak revision, Derrick Broze notes that references to "Emergency Platforms" were removed from the 3rd to the 4th revision of the Summit’s Pact for the Future. The 5th revision just published has swapped in the words “complex global shocks” instead:

Action 54. We will strengthen the international response to complex global shocks.

82. We recognize the need for a more coherent, cooperative, coordinated and multidimensional international response to complex global shocks and the central role of the United Nations in this regard.

And where has this latest fear-mongering, permanent “planetary emergency” mode originated? Ah, once again it’s the Club of Rome (you may remember the mention in my earlier Stack Can’t handling the truth).

“Let’s be clear, the future is not just happening, the future is built by us, a powerful community here in this room. We have the means to impose the state of the world.”

— Klaus Schwab, World Economic Forum (WEF), Davos, May 24, 2022

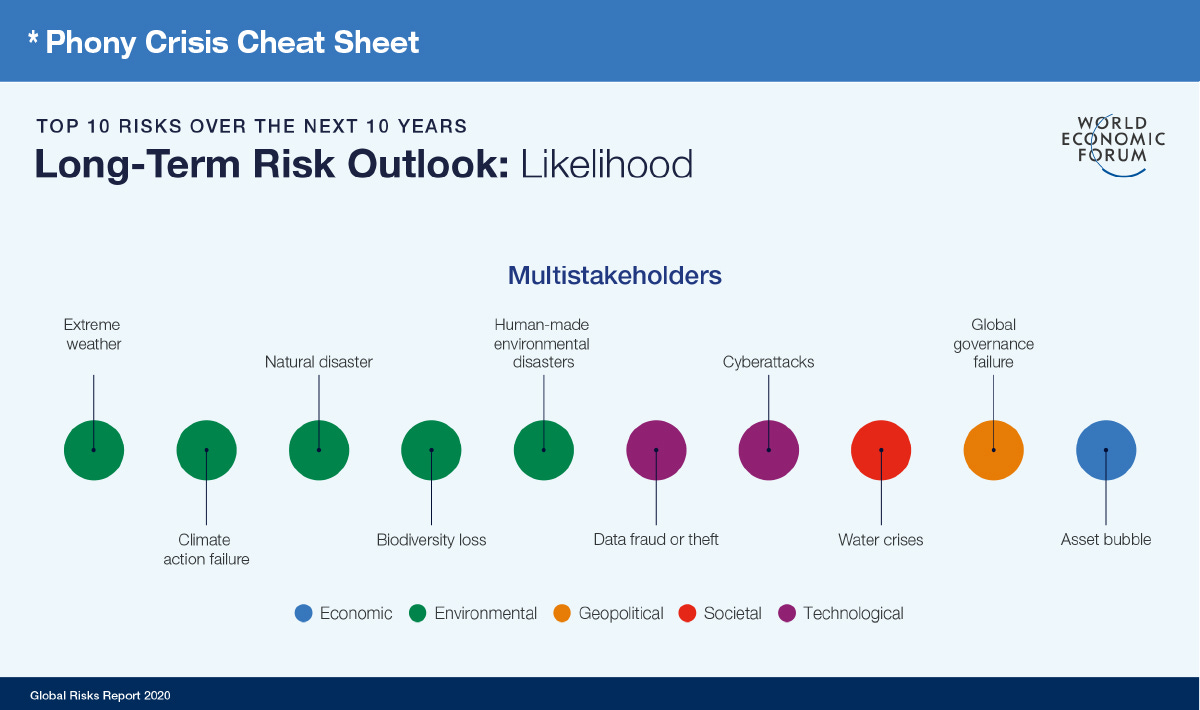

Let’s be clear, we regular humans are NOT considered actual “stakeholders” in any UN, WEF, or Club of Rome picture. We have no vote (not even a pretend one). When was the last time you got an invite to Davos?

Since puppet “heads of state” just do as they’re told and mutter repeat the lines,(“Biden,” Brazil President Lula) and the designated heroes on the “campaign” trail (both funded by Bilderberg Groupies) just carry on the distract, divide and conquer cabal puppet theater show, it’s up to us regular humans to buckle down to the real work to create the future we actually want.

What kind of a future do WE want?

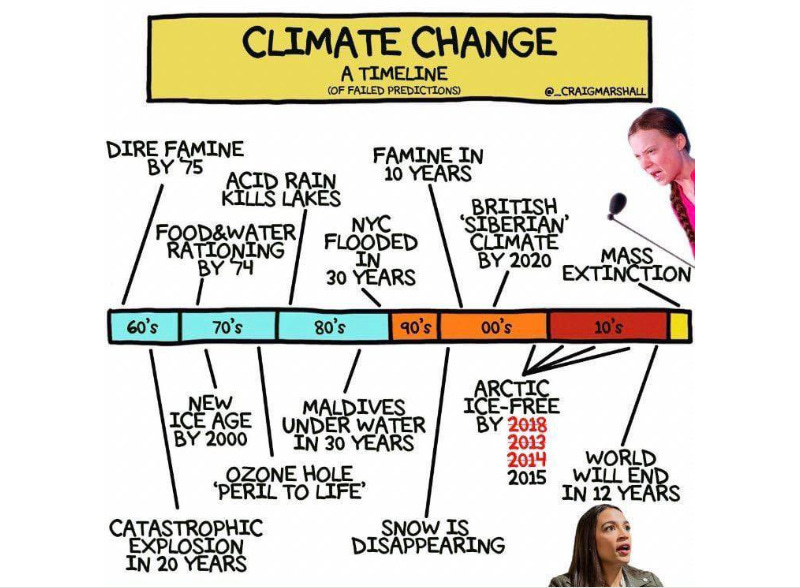

As George Lucas said, “You can’t do it unless you can imagine it.” And if we’re full of fear and false narratives, we’re not going to imagine better things than the disasters we’re being told to expect by the manipulation and control machine. The globalists are counting on this. That’s the point of the 24/7 fear narratives.

What kind of a financial system do WE want?

Seeing as they’re cuing up a “sweeping overhaul” of the global financial system tomorrow, let’s unpack what they’ve been working on and start to consider what opt-outs would work and how alternative options might operate.

Behold the globalists’ “Finternet”

The Bank of International Settlements (BIS) — the bank the central banks use — the mother-of-all-banks not unlike the gigantic Omega mimic under the Louvre in Edge of Tomorrow — is about as close to the top of the cabal as we’re allowed to perceive. In April, they issued a 44-pg “working paper” titled Finternet: the financial system for the future. What does the paper tell us this future will be? The TL/DR summary:

“The finternet will merge into digital public infrastructure where anonymity is abolished, money is programmable & citizens are coerced into compliance.”

It’s a well written paper full of good sounding “inclusion” words and such, until you look at the enormous truths they’re leaving out and what you’ll need to give up to participate.

A few excerpts below. Examine what they consider to be a main “problem”:

According to the World Bank’s Findex database, while 76% of adults had a transaction account, only 55% owned a debit or credit card and 59% made a digital payment in 2021. Access to credit and savings is even more constrained, with only 28% of adults borrowing from a formal financial institution and 29% saving money in the financial system. … Ultimately, access to credit and financial services is instrumental in empowering individuals to escape poverty by investing in human capital and other income-generating activities and enhancing overall economic inclusion.

What they’re really saying here is: NOT ENOUGH PEOPLE ARE BORROWING MONEY FROM US (AT OUR HIGH INTEREST RATES). Borrowing money FROM BANKS is a way out of poverty!

Greater use of digital payments is associated with less economic informality, ie a smaller share of the “shadow economy.” This may reflect the use of digital payments to merchants, and digital payments for payroll, in creating a data trail that helps to formalise previously unrecorded (cash-based) activities.

In other words, they DON’T want you to use untrackable “shadowy” cash anymore. (Of course the cabal will still use untrackable shadowy cash.)

And the central banks demand supremacy over all:

Not everything should change. Many of the key underpinnings of today’s financial system, such as the two-tier structure with a clear role for the public and private sector, should remain in place. Central bank money should still serve as the trusted foundation of the financial system, with settlement in wholesale central bank money on the central bank’s balance sheet being the determinant of finality in financial transactions. Commercial banks should retain a key role as intermediaries between savers and investors and as providers of commercial bank money. But even in these cases, the assets that these institutions offer to the public should take on more advanced technological representations, in the form of wholesale tokenised central bank money and tokenised commercial bank deposits.

(They add a sad tiny footnote:)

That said, traditional financial assets, including notes and coins, should continue to be available for individuals and businesses who wish to use them.

(Lepers can use cash.)

The concept of unified ledgers does not mean “one ledger to rule them all” — a single ledger that encompasses all financial assets and transactions in an economy.

(I’m guessing that’s exactly what it means.)

As in today’s financial system, the monetary system in the unified ledger system would have two tiers. Central bank money would represent the first tier and commercial bank money the second. Settlement of commercial banks’ accounts on the central bank’s balance sheet is the ultimate guarantee of finality of any financial transaction. As such, wholesale central bank money is a necessary foundation for any unified ledger. Tokenised wholesale central bank money would play a similar role to reserves in today's financial system, but offer the enhanced functionalities afforded by tokenisation. Some central banks might also choose to issue tokenised central bank money in retail form – a digital equivalent of today’s banknotes – to provide additional choice for users.

Commercial bank money would exist on unified ledgers in the form of tokenised deposits. These assets would provide the natural retail complement to wholesale tokenised central bank money.

footnote: Unlike so-called stablecoins, tokenised deposits would not be bearer instruments. Instead, they would trade using a “burnissue” model. Asset transfers are accomplished by deleting (“burning”) tokenised deposits at the payer’s bank and assigning (“issuing”) new tokens at the payee’s bank. The deletion and creation of private money tokens has an associated movement of tokenised wholesale central bank money.

What this means: your digital money (money is already digital commercial bank money) would be turned into tokens, which is the same digital thing as you have now, but with an added bunch of meta data, just as each photo in your phone has time and place etc. meta data attached.

Which Bilderberg Groupie is going to program your tokenized money?

Oh and the tokens are “programmable”:

Asset programmability would make it possible to embed adherence to relevant rules and regulations within the tokens and transaction instructions in the system. In other words, policy would exist as code.

The policy code programmed by whom? What are the chances we get a vote in the “policy” controlling how our money works / doesn’t work? It’d be great if we could program every dollar with a meta stamp saying “this dollar cannot be used in any war.” But that’s not what they will do. Wars are FOR money laundering.

This entire overhaul is being purpose-built to reach arbitrary “sustainable development goals” propped onto the phony crisis of “climate change.”

Back to the UN’s Pact:

Action 52. We will accelerate the reform of the international financial architecture so that it can meet the urgent challenge of climate change.

More critical questions about the Finternet future: who makes the tokens, and what assets get turned into tokens?

The process of tokenisation sits at the core of the Finternet. This is where assets are converted into digital tokens by token managers – entities that could range from central banks and commercial banks to asset management companies and private corporations. …

Additionally, users have the autonomy to manage tokens they create, acting as their own token managers.

Governance within the Finternet is intricately crafted, automating regulatory compliance and enforcement at the token level through the pivotal role of token managers. These managers are the custodians of compliance, intricately weaving legal and regulatory mandates directly into the architecture of each token.

The “what is an asset” question is ominously answered in part in the UN Pact:

(f) Promote greater use of debt swaps for the SDGs, including debt swaps for climate or nature, to developing countries, as appropriate.

About those debt swaps:

“The reality is that no global-north country has any intention of dispersing significant amounts of new grant money. … All you get is these conditional financial instruments designed to benefit primarily global private investors.”

— Frederic Hache, co-founder of the independent think tank EU Green Finance Observatory

Quelle surprise!

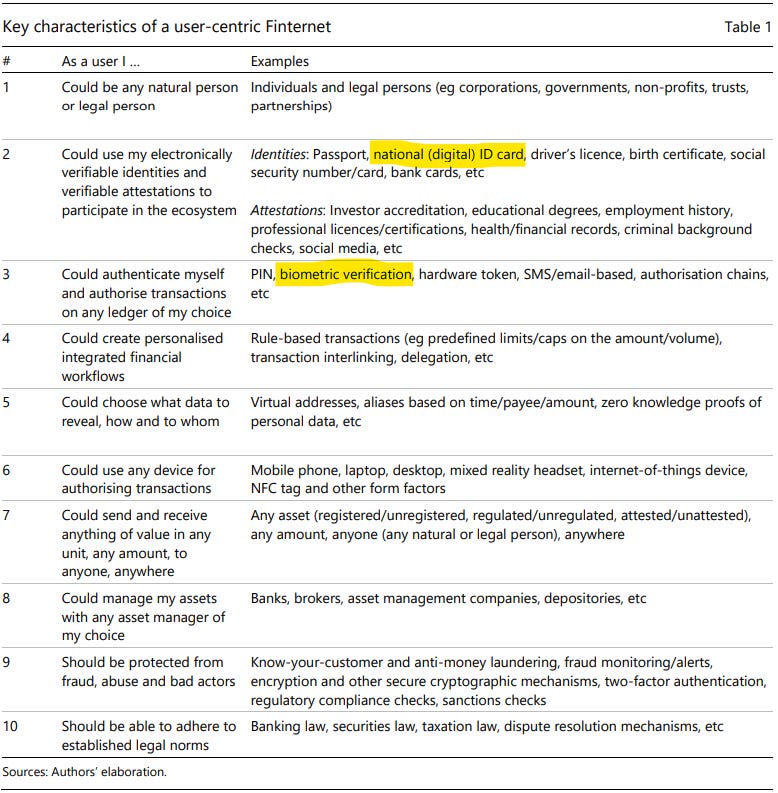

And underpinning it all: biometric digital ID:

By embedding advanced identity verification mechanisms that leverage biometric data, real-time authentication and digital signatures, the system ensures that only legitimate users can enter, and protects users from identity theft.

Back to what kind of a financial system do WE want?

The globalists’ plan for a sweeping overhaul of the financial system has nothing to do with saving the planet. It’s all about setting up a control system that expands ever more into everyone’s lives. More data — trackable tokenized money and biometric digital IDs — means ever more sophisticated, targeted, and accurate economic and social control. Their desperation to impose such an overhaul is likely because they know we regular people are gaining far more understanding of how they operate and this clarity threatens the sovereignty of the elite.

Also recall the main problem the BIS stated: NOT ENOUGH PEOPLE ARE BORROWING MONEY FROM US.

What the BIS working paper does NOT include is the key fact that banks keep all to themselves the central power we all could reclaim for ourselves: to create credit out of “nothing.” The great majority of our money supply is created by commercial banks when they make loans — this is the “commercial bank money” the BIS refers to. The creation of money is accomplished by a bookkeeping slight of hand known as double entry bookkeeping. I’ll dive more into this topic in a future Stack.

“The bookkeeper can be king if the public can be kept ignorant of the methodology of the bookkeeping.”

— from a document allegedly containing the doctrine adopted by the Policy Committee of the Bilderburg Group during its first known meeting in 1954

At this time, public consent is still essential to their plans. So this indicates a real path out of their antihuman systems: work on developing parallel systems and / or figure out a way of existing outside of them. Aside from using more cash, we’re going to have to Buckminster Fuller it since we’ve been trapped in this monetary system built by these globalists all our lives.

If there were no money, any system of crediting sellers and debiting buyers would be fully competent to accomplish the work now performed by money.

— Hugo Bilgram, 1914

To start off this imagining conversation, Thomas H. Greco, Jr. — a recognized expert in the fields of money, mutual credit systems, community currencies, and financial innovation — recently published a fascinating chapter of his updated book detailing how mutual credit clearing circles can do essentially what the BIS does — settle accounts — without actual currency needing to be exchanged.

“The ultimate step in reciprocal exchange, then, is the direct clearing of purchases against sales. Goods and services pay for other goods and services, so money, as we’ve known it, becomes obsolete. Direct credit clearing among buyers and sellers obviates the need to use any third-party currency or credit instrument, such as bank credit or government fiat currency, as a payment medium. Direct credit clearing is the “gunpowder” that makes the “castle” defenses of conventional money and banking obsolete and useless. Just as the adoption of checks allowed banks to circumvent the legal limitations imposed on the issuance of banknotes, so does the adoption of mutual credit clearing circles allow traders to free themselves from the limitations imposed by the monopoly of bank-credit and government-created money.”

Imagine that! We all create credit clearing circles within our communities and experiment with what rules work best for us and our realities. I’ll explore this idea in more depth and as well as other outside-the-box solutions in my next Substack.

Yes Truthbird, I agree we are far from powerless. We are the ones with the real power imo otherwise the globalists wouldn’t spend a trillion $ on propaganda, false flags, etc. They NEED our buy in, our consent, to create their version of reality. When none of us believe the narrative, it doesn’t come to pass. So there’s our power. It’s amplified more when we pour energy into building our own things from that higher resonance of courage and above. I wrote about this in my first substack Getting to courage. I’m sorry to hear of your experience as a targeted individual. Thank you for the link. I hope all the energy shifts from all dark tactics.

"We" (living human beings who embody and are dedicated to goodness, truth, justice, decency, Godliness, holiness, and divine reality) have no political power in this Fascist / Nazi / Satanic / Globalist game. Pretending we do is folly. However, that does not mean we are powerless. It means we must not play their games. We must work in other ways.

I am a Targeted Individual, and have been one for thirty-four years, which is half my entire life. Please study - in depth - this website for information about what I mean by "Targeted Individual":

TargetedJustice.com/